EDFI MC catalyst role – AgriFI and ElectriFI 2022 Annual Reports

One of the roles that we embrace wholeheartedly is our “catalyst role” as it enhances our impact-driven, development-focused investments.

“One of the key things about catalytic capital is that it unlocks opportunities that might not otherwise be possible. It’s like the spark that ignites a fire, jumpstarting projects and building a track record that can attract other investors to join in. – Rodrigo Madrazo, CEO EDFI Management Company”

In the context of impact investing and finance, it refers to our function of providing high risk resources to our investees with the primary purpose of testing their business plans and enhancing their overall viability. This way we contribute to attract additional capital from other investors who might otherwise be hesitant.

Not all ideas or entrepreneurs are ready for traditional investors. They might need a helping hand to onboard. Catalytic capital provides that helping hand, creating at the same time value, jobs, and wealth in underserved communities.

Investing in projects that are just starting out or in communities that are underserved can be risky. But that’s where catalytic capital shows its courage. It’s willing to take on those risks, paving the way for new solutions and models. Our investments rely on a sound financial, legal and ESG analysis to grow promising early-stage businesses and support them to access additional financing.

Measuring Success: More Capital Follows

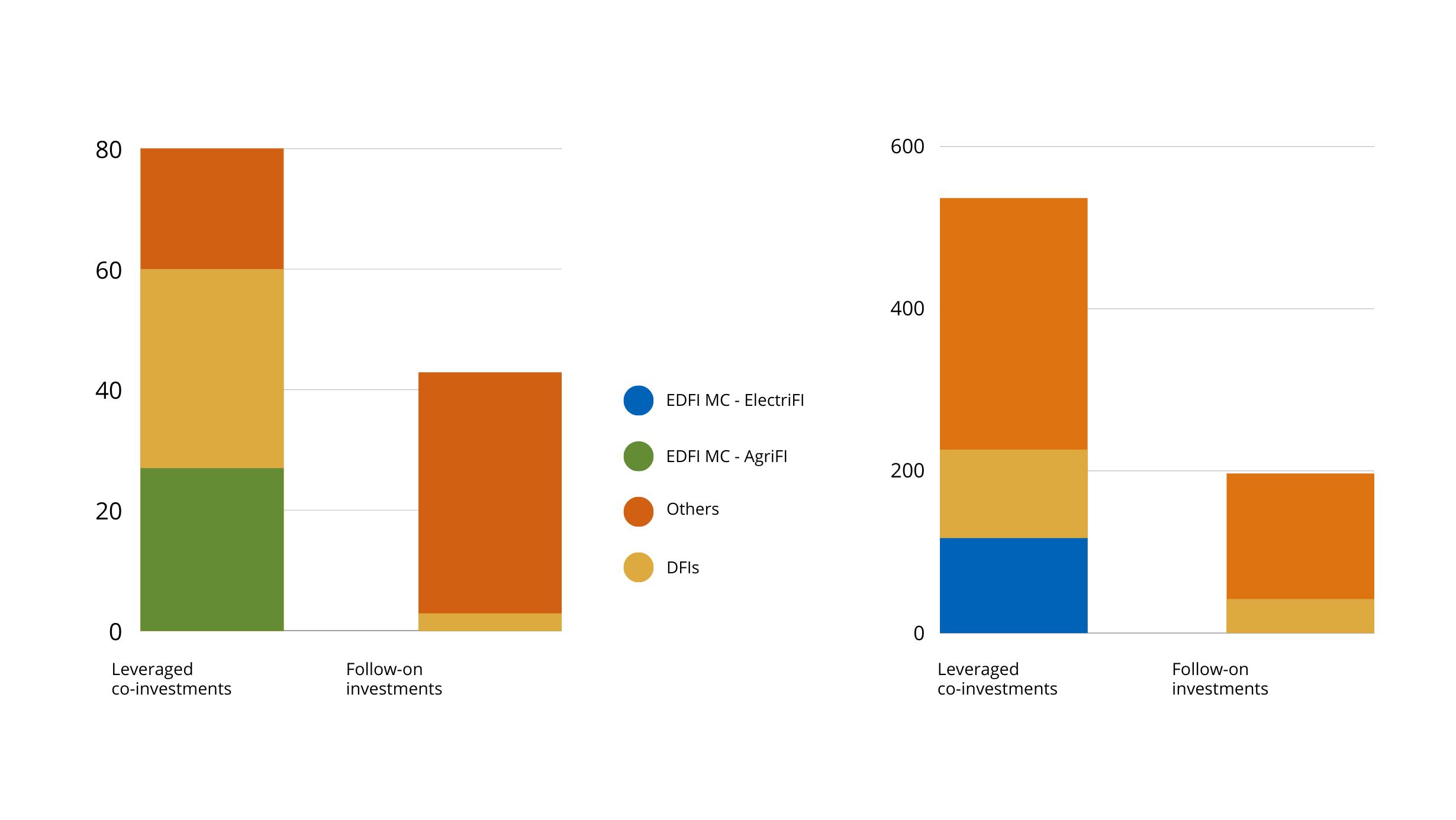

- ElectriFI’s total investment has leveraged an extra € 414 million of additional commitments in the coming years, resulting in a leverage factor of 4.2.

- Leverage factor of AgriFI is 3.1 X for (our 26.6 million drew in 53 million co-investments + 42.8 million in follow-on investment)

We embrace the role of a catalyst by providing EU funded solutions to our portfolio companies, and accepting disproportionate risk or concessionary returns to generate positive social or environmental impact. In essence, we enable third-party investments that might otherwise be unfeasible. We play this role under a Team Europe approach. We work closely with European DFIs, the European Commission, EU delegations and governmental institutions – 75% of our portfolio value, currently is a joint investment with one or more of the European DFIs.

One of the examples is Nuru, one of Africa’s pioneering renewable energy-powered metrogrid companies. Nuru (Swahili for “light”) is a company dedicated to enhancing connectivity in the Democratic Republic of Congo. Nuru deployed Congo’s first solar-based mini-grid in 2017 and has a 1.3MW solar hybrid site in Goma, the largest off-grid mini-grid in sub-Saharan Africa, another solar hybrid site in Beni and two in the oriental province (Tadu & Faradje). In 2018 we supported them through a Series A investment of USD 1.43m in equity and a loan. The investment took place in the context of severe security issues as well as the Ebola outbreak in the rural areas of North Kivu.

Nuru recently closed Series B with market-leading equity investors including Voltalia, E3 Capital, Proparco, the International Finance Corporation (IFC), the Global Energy Alliance for People and Planet (GEAPP), the Renewable Energy Performance Platform (REPP), the Schmidt Family Foundation, Gaia Impact Fund, and the Joseph Family Foundation.

We embrace the role of a catalyst by providing EU funded solutions to our portfolio companies, and accepting disproportionate risk or concessionary returns to generate positive social or environmental impact. In essence, we enable third-party investments that might otherwise be unfeasible. We play this role under a Team Europe approach. We work closely with European DFIs, the European Commission, EU delegations and governmental institutions – 75% of our portfolio value, currently is a joint investment with one or more of the European DFIs.

- ElectriFI’s total investment has leveraged an extra € 414 million of additional commitments in the coming years, resulting in a leverage factor of 4.2.

- Leverage factor of AgriFI is 3.1 X for (our 26.6 million drew in 53 million co-investments + 42.8 million in follow-on investment)

Dive deeper into our annual reports, explore other accomplishments and meet some of our investees, here: