InfoPoint event – A Reflection on AgriFI’s five years

With the occasion of the 5th anniversary of AgriFi, we organised, together with our EU colleagues, an InfoPoint event with the objective to highlight some of the AgriFI accomplishments since we launched it and to provide insights into the utilisation of EU blending instruments to unlock, accelerate, and maximize sustainable agriculture finance. This milestone event served as an opportunity to assess AgriFI’s journey over the past five years, its accomplishments, challenges, and aspirations for the future.

Setting the Scene: A Vision for Agriculture

In the opening session of the event Cristina Vicente Ruiz, AgriFI Programme Manager, DG INTPA – F3, set the stage by acknowledging AgriFI’s evolution since its inception in 2018. As somebody who led the programme from its inception, she raised critical questions about the challenges of derisking agricultural investments for smaller ticket sizes and the integration of specific value chains, underscoring the importance of sustainability and standard setting in achieving impactful outcomes.

“AgriFI was born out of the recognition that traditional financing mechanisms were not sufficient to meet the needs of SMEs and agriculture.”

Cristina Vicente Ruiz, AgriFI Programme Manager, DG INTPA – F3

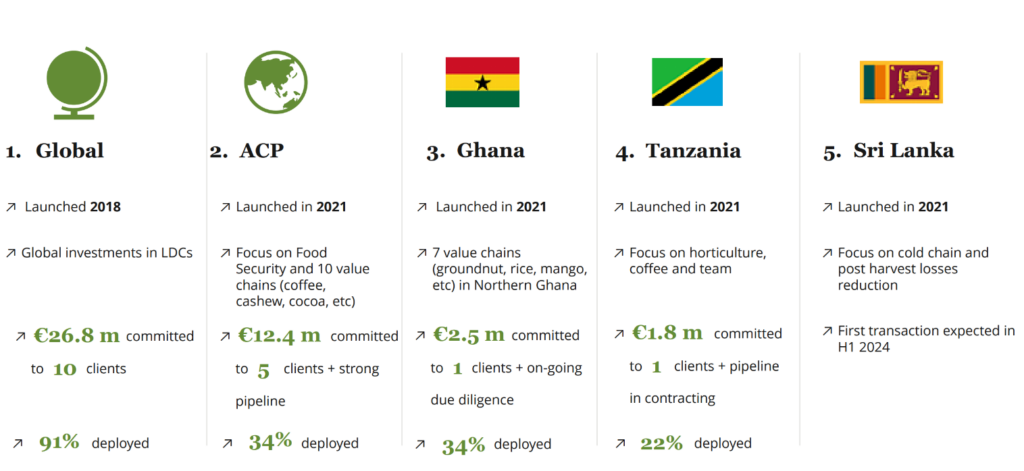

Cristina specified the details about the AgriFi mandates coming from the Global window, Regional Window ACP and 3 country windows – Ghana, Sri Lanka and Tanzania.

Leonard Mizzi, Head of Unit at INTPA F3, emphasized AgriFI’s pivotal role in addressing the financing needs of SMEs and agriculture in developing countries. He highlighted AgriFI’s commitment to long-term investment in the missing middle, driving economic growth, enhancing food security, and empowering communities. He added “AgriFI’s investments have catalysed economic development and job creation in fragile markets.”

Investing with Impact: The AgriFI Approach

Lionel Dieu, AgriFI Fund Manager, provided insights into AgriFI’s investment criteria and portfolio composition. He highlighted the role of AgriFI to support smallholders in developing countries on their path to commercial & sustainable farming, throughout the entire agriculture value chain by working i.e. with producers organizations, processors, aggregators, export-oriented companies, and agri-inputs providers. He explains that AgriFI’s ultimate goal is to unlock, accelerate and leverage investments by both EDFIs and Impact Investors.

He highlighted the pivotal role of AgriFI in addressing the financing gap for early-stage projects and companies in the agricultural sector, particularly those that empower smallholder farmers and rural communities.

Lionel elaborated on AgriFI’s commitment to long-term investment in the missing middle, a segment often overlooked by traditional financing mechanisms. “By providing tailored financial products, including, equity, debt and quasi-equity investments, AgriFI aims to bridge a funding gap between seed capital and commercial investors. The investment horizon of the facility is long term, meaning this gives sufficient time to enterprises to become financially self-sufficient, improve productivity, and access new markets. This approach not only drives economic growth but also enhances food security and fosters inclusive growth in developing countries.” – he stated.

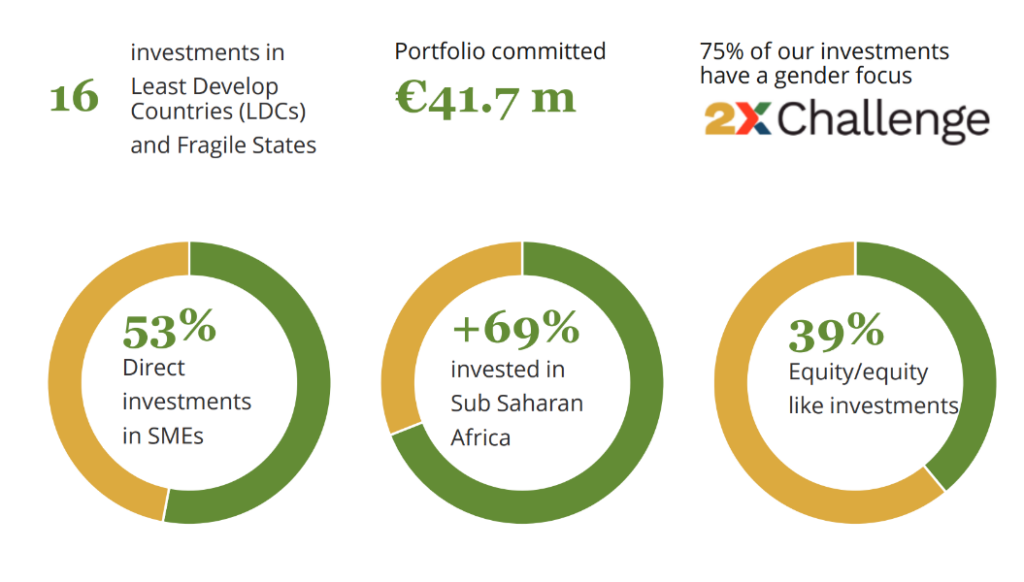

The AgriFI Fund Manager also highlighted AgriFI’s geographic emphasis on fragile states and sub-Saharan Africa, where investments are most needed to address pressing challenges and unlock untapped potential. By strategically directing investments to these regions, AgriFI aims to catalyse economic development, job creation, and resilience in communities facing adversity.

Lionel emphasized the 3 main added value characteristics of AgriFI:

- The provision of Long(er) Term Financing: Funding needs to cover Capital Expenditures (CAPEX) are key for agri-SMEs but are still largely unmet. This is something that AgriFI can do – 48% of AgriFI investments are in long term CAPEX to early-stage companies – Lionel provided some concrete examples of investments of this kind made by AgriFI (non-exhaustive): Gebana Burkina Faso for dried mango; Cajou Espoir Togo for cashew nut; La Laiterie du berger for dairy, etc. The aim of these investments is to allow local companies to build assets, create local jobs and create more in country local value addition.

- AgriFI makes the link between DFIs, Impact Investors and the European Commission – AgriFI catalysed €118 m in co-investments (2023). Concretely, this has been illustrated by joint due diligence, opportunities brought to the addition of investors and AgriFI liaising between investees and the European Commission’s support programmes.

- Investing in fragile countries (Low Income and Lower-Middle Income Countries), but also contexts – Examples include the AgriFI investments in Burkina Faso over 2022-23 i.e. during a period where the country was impacted by political turmoil and terrorism, 37,4% of AgriFI Total Commitments is in Fragile States as per World Bank. Lionel also provided other examples like an investment in an MFI in Myanmar Maha; another investment in the Northern region of Nigeria, supporting rural youth and contributing to the enrolment of 12,000 smallholder farmers involved in the maize value chain; an early-stage investor in INUA Fund i.e. a Private Equity Fund taking stakes with a gender lend in SMEs in Uganda.

In conclusion, Lionel underscored AgriFI’s pivotal role in unlocking sustainable agriculture finance and driving positive change in developing countries via these concrete examples. Through a combination of strategic investments, rigorous due diligence, and collaborative partnerships, AgriFI remains committed to advancing the global agenda for inclusive growth and resilience.

Towards a Sustainable Future: Expansion and Growth

Looking ahead, AgriFI aims to double its portfolio by 2026, with a focus on scaling impact and reaching a broader base of smallholder farmers. Initiatives such as the set-up of the technical assistance facility for the beneficiaries of the investments and two new Nexus windows combining agriculture and renewable energy, underline AgriFI’s commitment to innovation and sustainability.

Building Partnerships for Impact

Regis Meritan, Head of Sector at INTPA F3, concluded the event and emphasized the collaborative nature of AgriFI’s approach. In his view, 5 years is a too short timeframe to see the success, even though AgriFi has demonstrated a good record with over 42 million invested and 180 million mobilised.

“It’s good start, I would say. The basic idea, and I think it’s important to always remember that, in our partnership with European DFIs, was that AgriFI makes a first step in investment in order to mobilise DFIs direct interventions afterwards. With the investments you have been doing, we will facilitate the upscale of investment through European DFI in the next 5-10 years. It’s good to see results now but we expect the next period to show the real impact.”

Regis Meritan, Head of Sector at INTPA F3

On top of that, Mr. Meritan reminds that “We have started with a global approach – a global window. But agricultural policy is first at a country level and this means evolution towards country windows.”

A Vision for Inclusive Growth

As the event concluded, it was evident that by unlocking sustainable agriculture finance and empowering rural communities, AgriFI is fulfilling its role as a catalyst for inclusive growth and resilience in developing countries.

You can see the full event video here.