Patient Capital for a Bright Future: Investing in Africa’s Off-Grid Energy

(this article was originally written for Afrive and published in French)

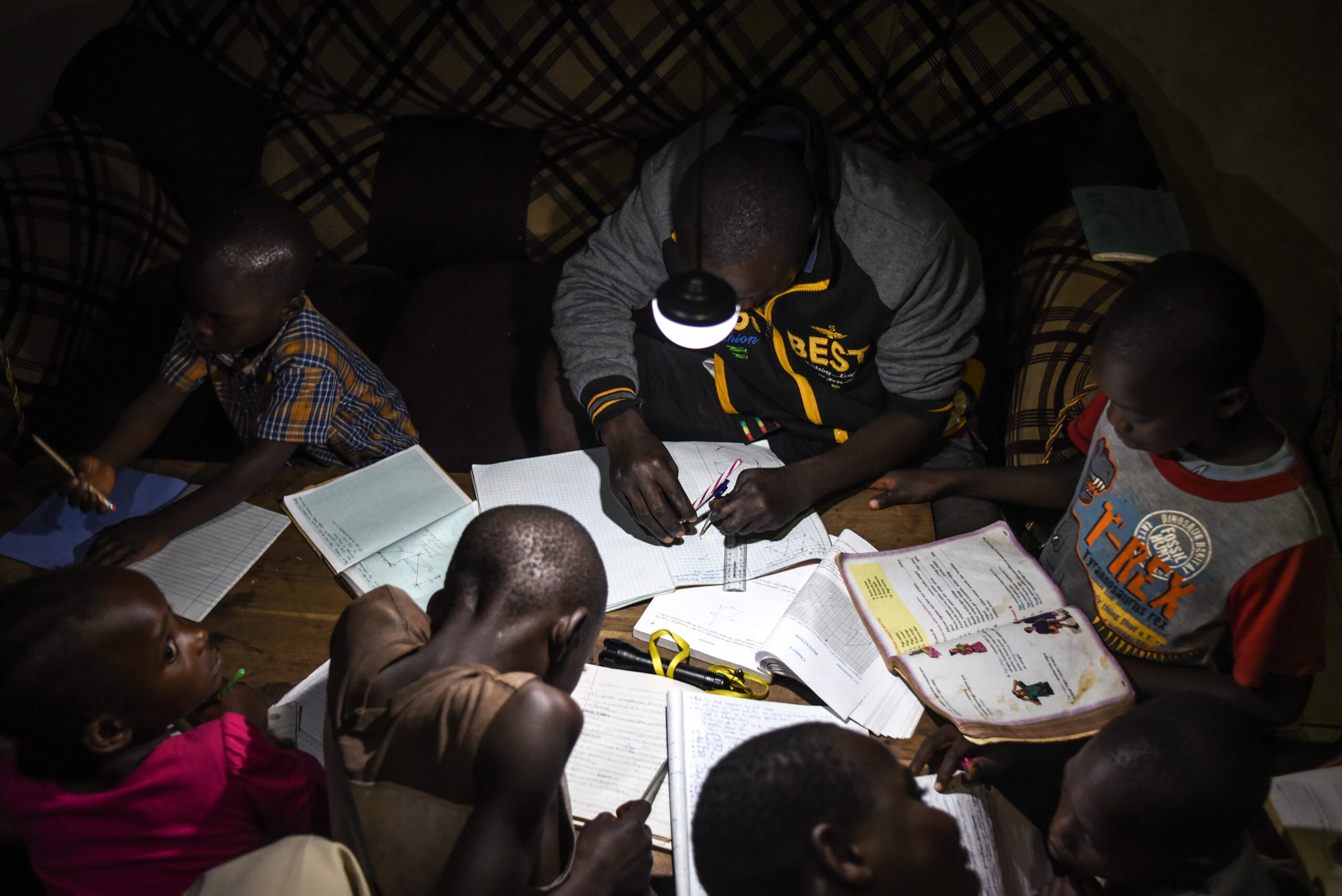

For the past five years working for ElectriFI at EDFI MC, I’ve had the privilege of witnessing firsthand the transformative impact of the off-grid energy sector. This dynamic industry has brought tailored, localized solutions to over 490 million people, providing access to energy in some of the world’s most underserved areas.

Through our investment mandate, we’ve supported over 50 small and medium enterprises (SMEs) that are not just expanding energy access, but also driving technological innovation in agriculture, creating economic opportunities, and building climate resilience. With 76% of these ventures based in sub-Saharan Africa, and nearly half involving equity participation, our strategy aims to meet the market’s needs and has provided us with a close-up look at its challenges.

The Equity Investment Dilemma

One of the biggest challenges we’ve encountered is the severe shortage of equity investment in the sector. Although African start-ups in this space have attracted 25% of the total investments, the bulk of this funding has been in the form of venture debt. And while venture debt has its place, it’s often a poor fit for early-stage companies grappling with unpredictable revenues in high-risk environments. Yet, due to the capital-intensive nature of off-grid projects, many start-ups had no choice but to take on this debt, leading to significant financial strain and, in too many cases, bankruptcy.

The off-grid energy sector, with its inherently long-term and high-risk profile, desperately needs patient capital. Although equity has been scarce, there are promising signs that this may change for companies that have managed to survive the storm. To understand the potential for this shift, it’s crucial to explore the factors behind the current equity drought.

Navigating the Post-Pandemic Economic Storm

The pandemic dealt a heavy blow to Africa’s off-grid renewable energy start-ups. Reliant on imports like photovoltaic panels and batteries, the sector faced skyrocketing material and shipping costs. These increases, paid in hard currencies, squeezed margins and forced companies to hike prices, which in the midst of an economic slowdown, led to reduced cash sales or riskier credit sales. The revenue hit from these moves was immediate, and the resulting unstable credits—denominated in local currencies—added to the chaos. Investors, already wary of unproven business models in uncertain markets, hesitated to provide the equity funding that was desperately needed. Instead, they leaned on debt instruments, mistakenly believing these were safer. However, servicing this debt, mostly in hard currencies, triggered a liquidity strain as the economic downturn deepened. Sales suffered, client credit repayments dwindled, and currency devaluations across Africa further eroded the value of these repayments. In this increasingly risky environment, many start-ups couldn’t secure the patient capital needed to sustain their operations, let alone scale and innovate.

Signs of Recovery and a Brighter Future

Yet, despite these challenges, the sector is showing signs of resilience. Several African economies are beginning to stabilise, creating a more favourable climate for investment. This was evident in July 2024, when capital investments in African start-ups reached a record high of $420 million—the largest for that month since 2019.

Most encouragingly, the start-ups that have weathered the storm have proven their adaptability and resilience. Adversity has spurred innovation, leading to business models that are better aligned with market needs. At the same time, sharp declines in the prices of solar panels and batteries are transforming the economics of off-grid solar, making it more competitive than ever. More success stories are starting to emerge, with some companies now consistently operating at a profit. In this evolving landscape, opportunities are also arising in the form of mergers and acquisitions, where resilient companies can rapidly scale by consolidating or acquiring competitors.

Case Study: Solar Panda – Innovating Through Adversity

Solar Panda designs and sells affordable, reliable solar home systems and appliances tailored to the needs of off-grid customers. Since 2018, they have operated in Kenya, one of the sector’s most competitive markets. When the pandemic struck, Solar Panda faced significant challenges: costs surged, the Kenyan shilling devalued, and some customers struggled to honour their pay-as-you-go contracts. Despite these obstacles, the company secured a $12 million equity round from EDFI MC ElectriFI, OikoCredit, and Export Development Canada (EDC) in 2022. This crucial investment provided the breathing space needed for Solar Panda to innovate.

The company enhanced its systems and completely reinvented its credit sales approach, pioneering solutions aligned with market demand and customer payment capacities. This pivot was further supported by an additional $6 million equity round from the same investors in early 2024. The result? Record-breaking monthly sales, consistent month-on-month profits, and ambitious plans to expand into new markets. Today, Solar Panda employs over 300 people, has sold more than 350,000 systems in Kenya alone, and has concrete ambitions to double its impact in the near future. This journey highlights how strategic equity investments and innovation drive success, even in the most challenging environments.

A Turning Point for Patient Investment in Off-Grid Energy

The improving outlook is unmistakable, and it is invigorating to see boardroom conversations shifting from survival mode to ambitious, long-term strategic planning. While equity investment has been scarce, there are promising signs that this is beginning to change. Recent announcements of new patient capital funds targeting the renewable energy sector indicate that the tide is turning. Notably, the $5 billion World Bank ASCENT program and the $250 million Hardest to Reach Fund are just starting to deploy their resources. Existing investors have sharpened their strategies, and even those who were previously uninvolved in the sector are now exploring the datarooms of promising start-ups. The time is ripe for investors to act boldly and invest in this emerging ecosystem. The challenges have been immense, but the opportunities are now equally significant. The future of off-grid energy in Africa is bright—if we’re ready to seize it.

The article is written and published in French for Afrive. We are publishing here the English version.

Author:

Guillaume Cruyt

ElectriFI Investment Officer

EDFI Management Company