ACPF – Access to Clean Power Fund

Period

2020

Sector

Renewable energy

Financial facility

ElectriFI

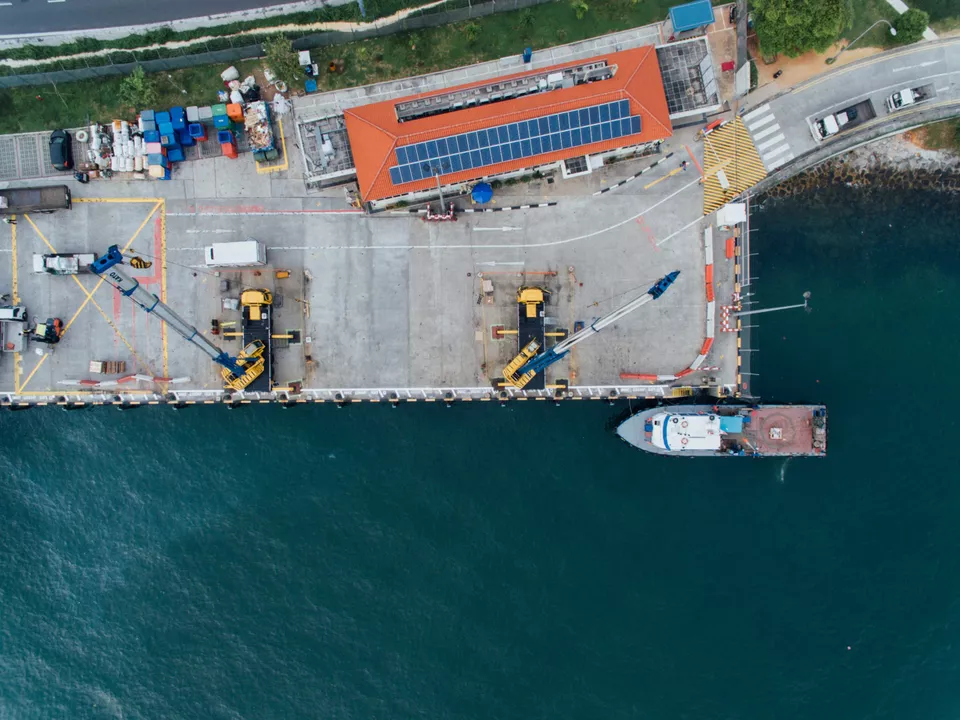

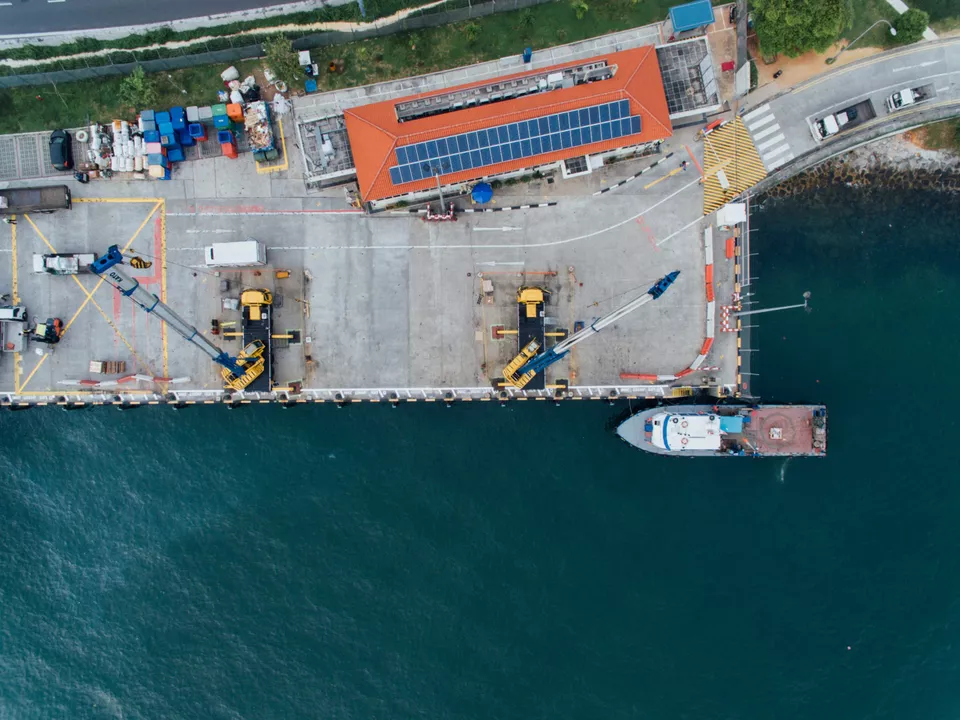

ElectriFI invest USD 3m in responsAbility Access to Clean Power Fund (ACPF) to contribute to several impact targets in line with SDG7.

Project overview

ElectriFI is providing additional first-loss capital for a responsAbility-managed energy debt fund targeting universal access to clean power. ElectriFI subscribed a USD 3m junior capital to responsAbility Access to Clean Power Fund (ACPF), a 10y closed-ended Luxembourg SICAV set-up to respond to the (debt) funding gap towards universal access to clean and affordable modern energy in underserved markets. ElectriFI’s investment aims to contribute to several impact targets in line with SDG7, notably: 865,000 tons of CO2 avoided per year, 4.41GW installed capacity and ~6700 jobs created over 10 years.

responsAbility Investments AG is a leading impact investor focused on private debt and private equity across emerging markets. responsAbility Access to Clean Power Fund (ACPF) is a private debt fund that seeks to address the lack of access to clean power globally, with a strong focus on Sub-Saharan Africa and South and Southeast Asia, and fills-in the unmet market demand for debt funding from small but growing C&I players (SMEs, schools, hospitals, etc.) in Asia and Africa mainly.

Funding objective

By further strengthening the Fund’s capital structure, responsAbility aims to mobilize additional private capital in line with SDG7. EDFI ElectriFI’s investment aims to contribute to several impact targets, notably: 865,000 tons of CO2 avoided per year, 4,41GW

installed capacity and ~6,700 jobs created over 10 years.

Investment rationale

ACPF fills-in the unmet market demand for debt funding from small but growing C&I players (SMEs, schools, hospitals, etc.) in Asia and Africa mainly. In addition to supporting ambitious and well-quantified

impact objectives (see above), this ElectriFI investment plays a clear catalyst role straightening the whole structure. Indeed, the ElectriFI instrument used is Junior Equity with first loss mechanism, which not only allows strict compliance with the fund risk ratio’s but also provide additional comfort to Senior and Mezzanine investors, hence attracting more funding.

Key Indicators

Financial Instrument

Equity

Amount

USD 3m

Year

March 2020

Targeted impact