Green Village Electricity – GVE

Period

2019

Country

Nigeria

Sector

Renewable energy, Solar PV

Financial facility

ElectriFI

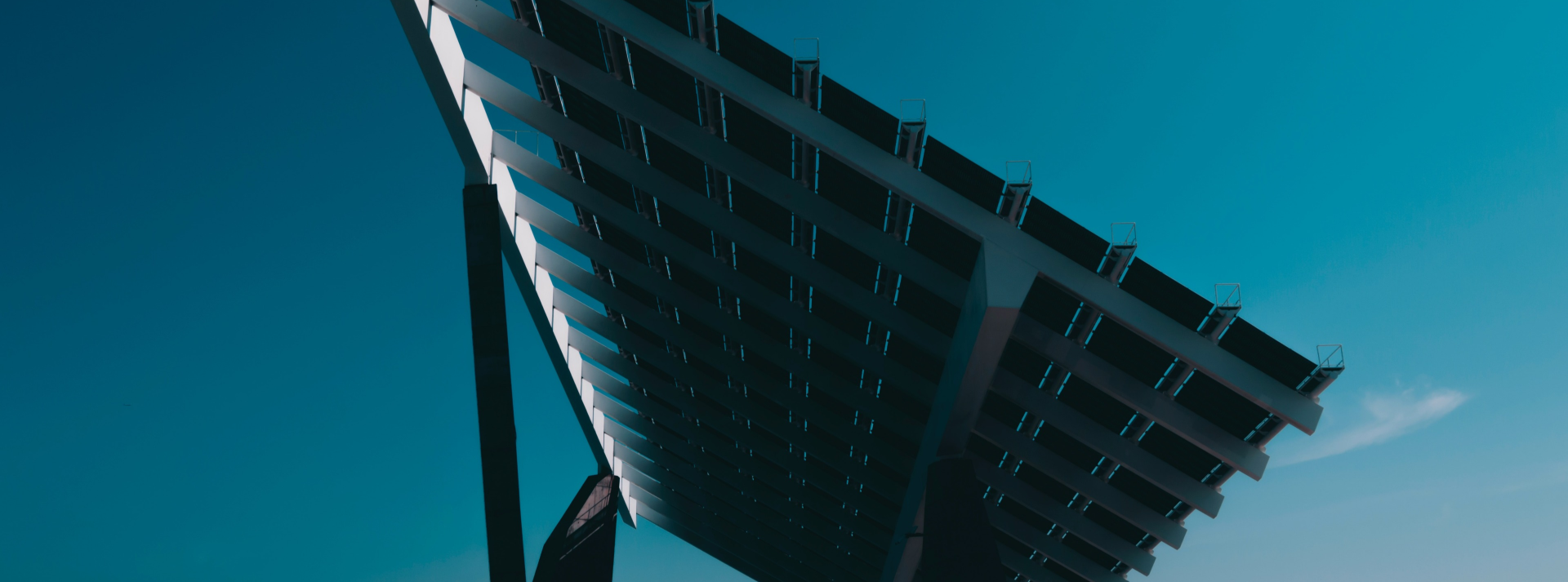

EDFI ElectriFI contracted a USD 0.75 million senior debt to finance the construction and operations of rural mini-grids across Nigeria, and contributes to the finalisation of the first phase of the Green Village Electricity’s medium term expansion plan which consists in the development and operations of 17 mini-grid sites for a total of 800kWp and about 4,000 new electricity connections.

Project overview

EDFI ElectriFI participated in PEG Africa’s USD 25m Series C round with a USD 5 million junior corporate debt that will enable the company to further grow its footprint in Ghana and Ivory Coast while at the same time it will pursue further international expansion into Senegal and other markets.

ElectriFI contracted in September 2020, an additional USD 1.5 million junior corporate debt to enable the company PEG Africa to further grow its footprint in Ivory Coast. This is EDFI ElectriFI’s second investment in the company, after participating with a USD 5 million junior corporate debt in PEG Africa’s USD 25m Series C round in 2019.

Starting commercial activities in 2015, PEG is the leading company deploying and financing solar to off-grid homes in West Africa, distributing industry-leading Pay-As-You-Go solar home technology to consumers who lack both access to reliable electricity and formal banking services. PEG has over 75,000 customers, over 450 full time staff working in 72 service centres across Ghana, Ivory Coast, and Senegal. ElectriFI will provide 20% of the financing required to grow the customer base up to around 128 000 customers, meaning providing access to electricity to more than 640,000 people. PEG is expected to employ 750 people by the end of 2020 and to have more than 1000 direct sales agents active in the field.

Funding objective

EDFI ElectriFI finances the construction and operations of rural mini-grids across Nigeria and contributes to the finalisation of the First Phase of the Company’s medium term expansion plan which consists in the development and operations of 17 mini-grid sites for a total of 800kWp and about 4,000 new electricity connections.

Investment rationale

This project perfectly fits with EDFI ElectriFI’s mandate of financing new clean and reliable electricity connections in challenging environment. EDFI ElectriFi’s additionality is high as mini-grids are not yet financed by commercial banks and the sector is not attracting yet the same level of capital as other off-grid electrification sectors may.

Key Indicators

Financial Instrument

Senior debt

Amount

USD 0.75m

Year

September 2019

Targeted impact